If you are living here in Nigeria you will know that Nigerian banks have implemented a policy restricting the use of Naira ATM cards for international online transactions.

As an online marketer or blogger living in Nigeria, you will find it difficult to buy things online using your Naira ATM card. This includes paying for domains, hosting, or subscription-based services.

However, some fintech companies like Grey, and Cardify has come together to introduce a virtual dollar card option that any Nigerian can sign up to use in making dollar transaction internationally. This makes it a lifesaver for most of us living here in Nigeria.

In this guide, I will show you step-by-step how to get a virtual dollar card in Nigeria using the Cardify Africa platform. Cardify is one the best virtual dollar cards that we use and it works for most international websites like Namecheap, etc.

What is Cardify?

Cardify is a startup fintech company in Nigeria that provides seamless payment services for Nigerian customers such as exchanging, spending, and saving money across multiple digital wallets.

It allows Nigerians to create and fund virtual dollar cards for both local and international spending, using either Naira (NGN) or digital currencies like USDT. With Cardify, you can also buy vouchers, pay bills, and top up airtime in various network providers like MTN, Glo, and Airtel.

What is a Cardify Virtual Dollar Card?

The Cardify Virtual Dollar Card is a virtual prepaid card issued by Cardify, a Nigerian financial technology company that can be used to make online international payments in USD rather than Naira.

You can fund the Cardify Virtual Dollar Card with either Naira (NGN) or digital currencies like USDT. Once you verify your identity on Cardify, it will generate a Nigeria-based account number in your name and a USDT wallet address that you can use to fund your account.

With the Cardify virtual dollar card, you can make purchases on e-commerce websites and freelancing platforms like Fiverr without having to use the Nigeria Naira ATM card which will automatically be declined and lead to frustration.

You can also pay for subscription services like Netflix, and Shopify or pay for domains and hosting on Namecheap, and Hostinger.

How To Get Virtual Dollar Card In Nigeria Using Cardify

In this guide, I will work you through the process of creating the Cardify Virtual Dollar Card. You will need the following things to proceed:

- Email Address: You will need a valid email address to use in the registration process.

- Phone Number: You will use your phone number in the registration process as well.

- BVN: BVN is a bank verification number that you can get when creating a Nigeria bank account (don’t worry it is safe to verify it on Cardify). Account to Cardify, they only use your BVN to confirm your full name, date of birth, and address.

- Utility Bill: This is an NEPA bill and it should not last three months.

- National ID Card: You can use either your NIN slip, driver’s Licence, Voter’s Card, or International Passport.

Once you have those things ready, it is time to set up an account on Cardify and get the virtual dollar card.

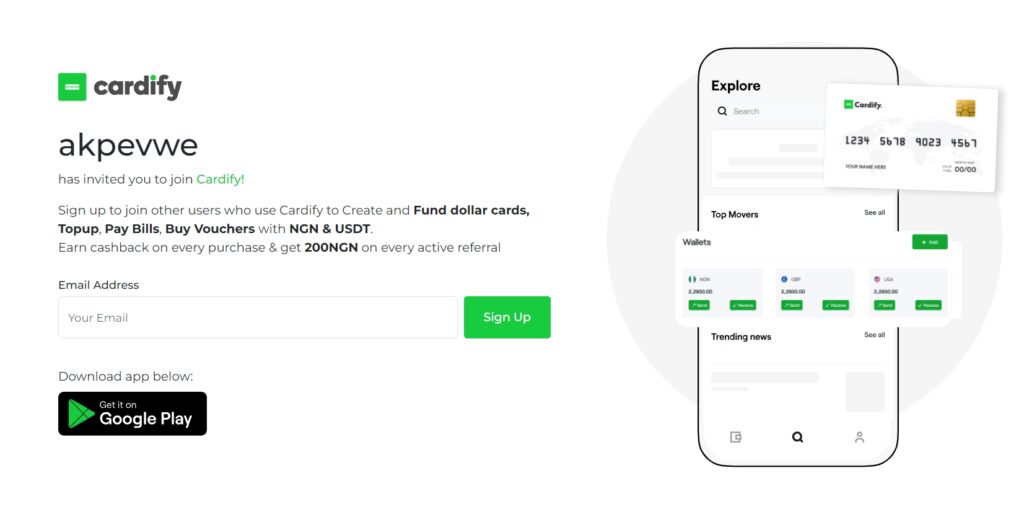

To set up an account on Cardify, click here. It will take you to the Cardify sign-up page (After creating an account, you will get an instant 200NGN bonus).

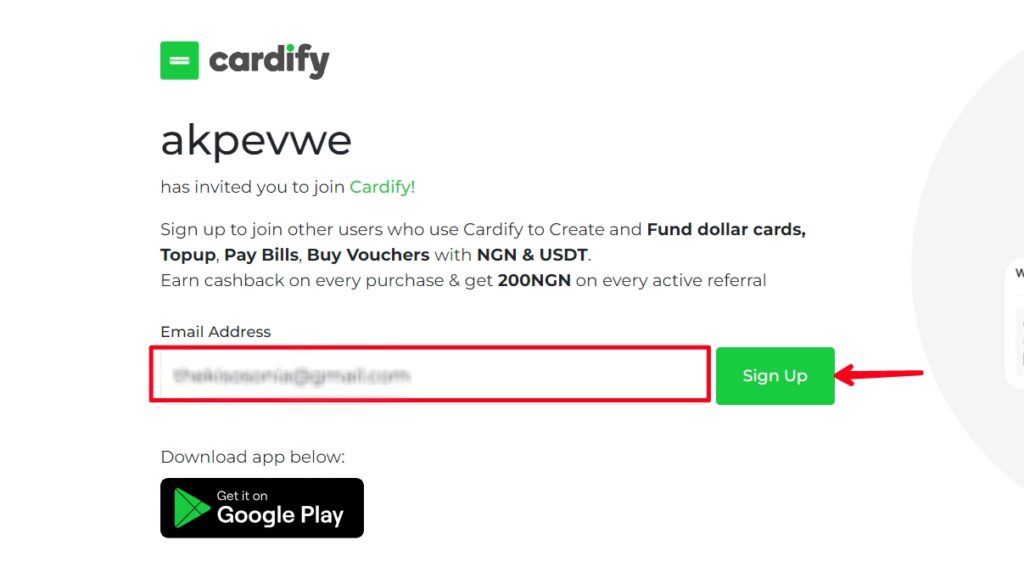

On the email address field, put in your email address and then click on the “Sign Up” button.

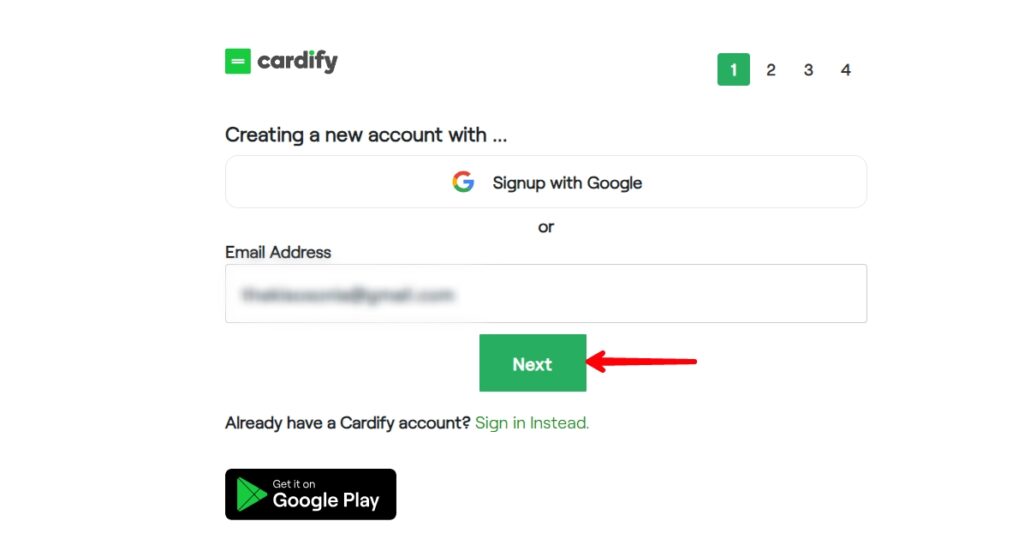

You will redirected to a new page, simply click on the “Next” button.

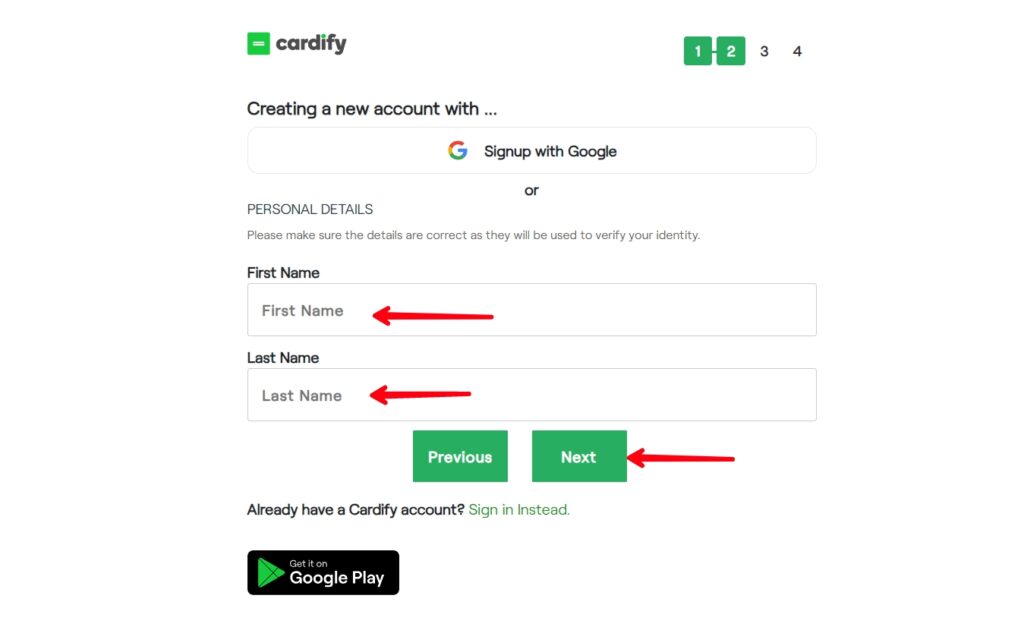

On the “First Name” field, write in your first name, and on the “Last Name” field, write in your last name and then click on the “Next” button.

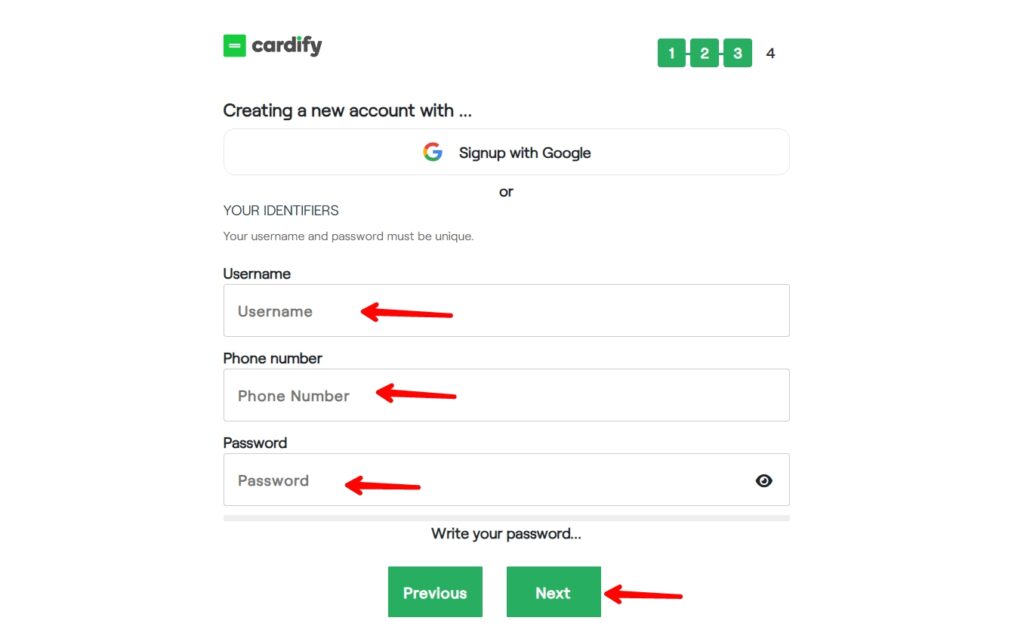

On the Username field, write in the username you want to use, on the Phone Number field, write in your phone number, on the Password field, write in your password then click on the “Next“.

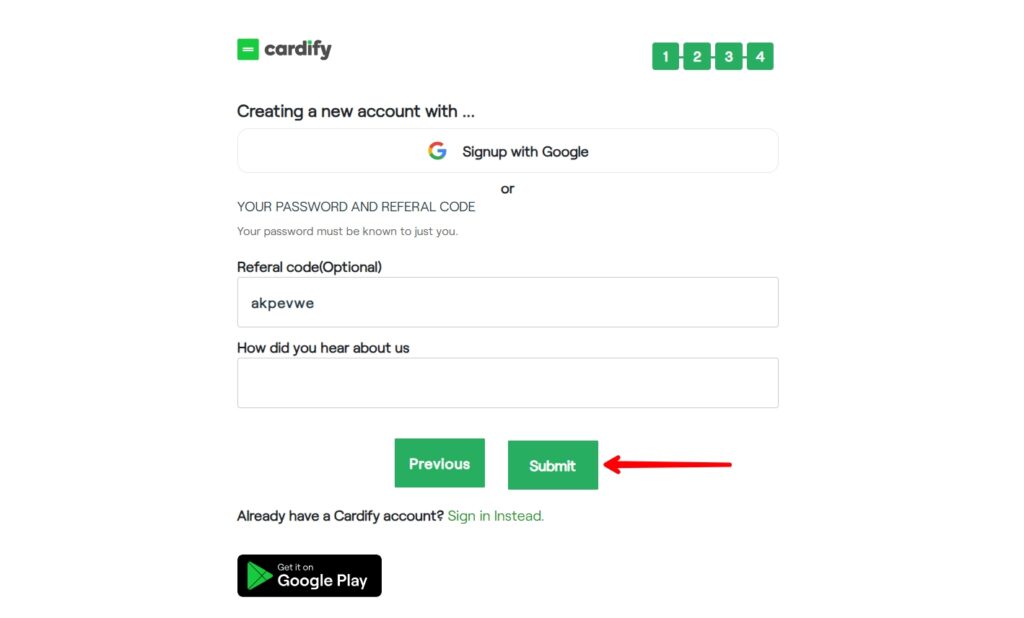

Finally, click on the “Submit” button.

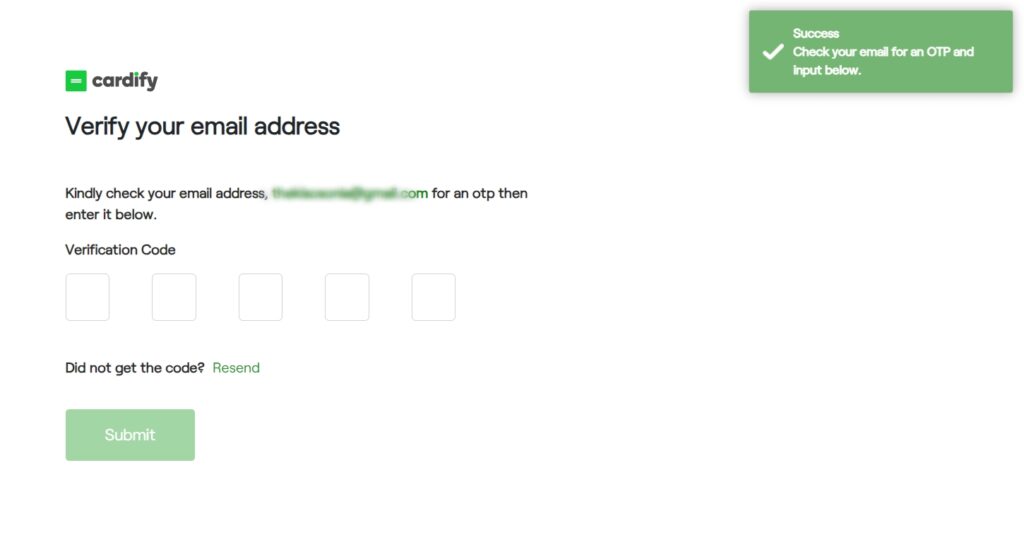

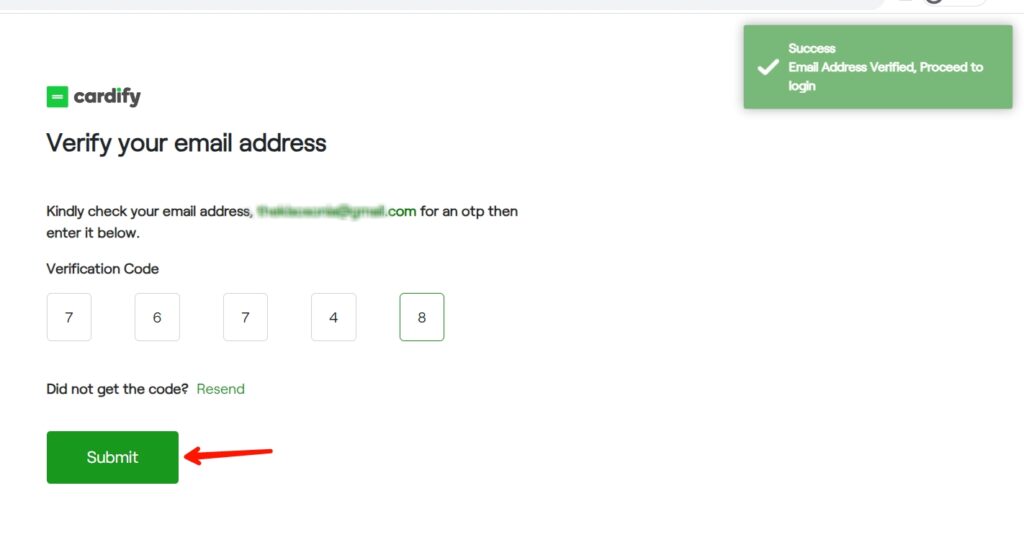

In the next step, you will be prompted to verify your email address. Check your email you will receive five-digit codes from Cardify, simply put them in the box and click on the “Submit” button.

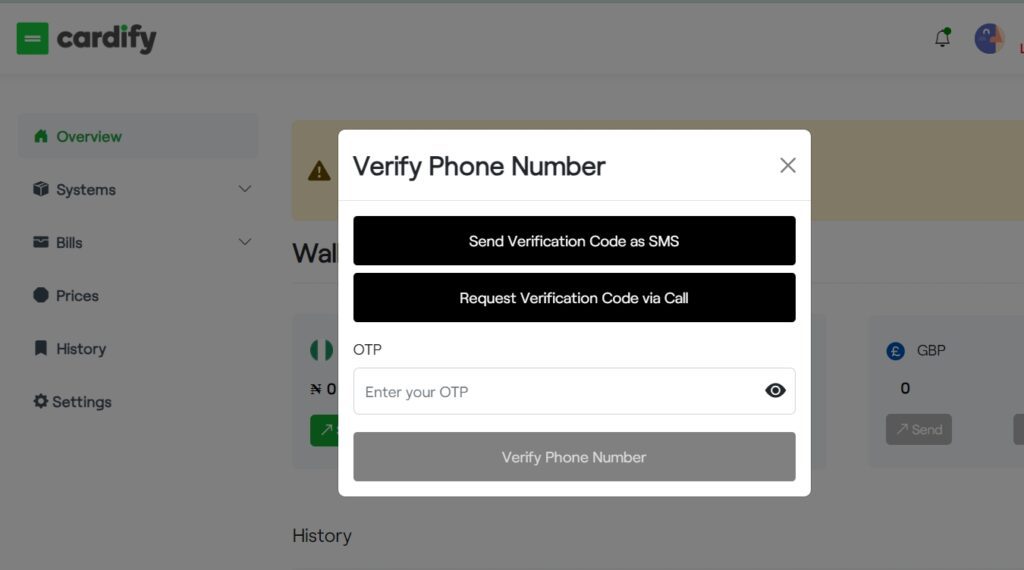

Once you verify your email address, you will be redirected to the Cardify dashboard. You will receive a pop-up to verify your phone number.

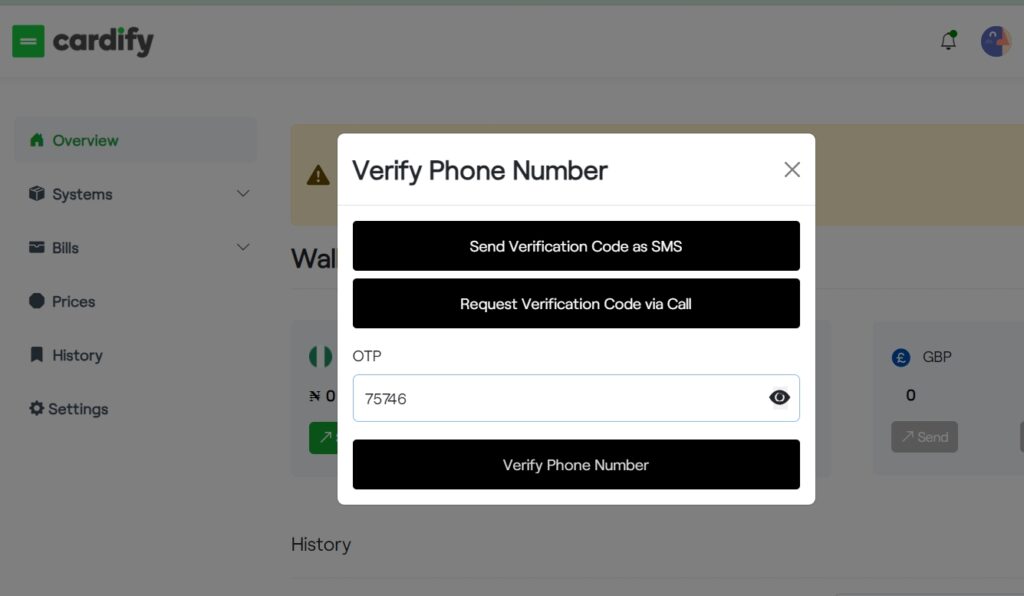

You have two options for receiving the code for verifying your phone number: Through SMS and Via Call. Simply click on “Send Verification Code as SMS” and then wait for the code to arrive.

Once you have received the code in your SMS, put it in the “Enter your OTP” field and then click on the “Verify Phone Number” button to verify your phone number.

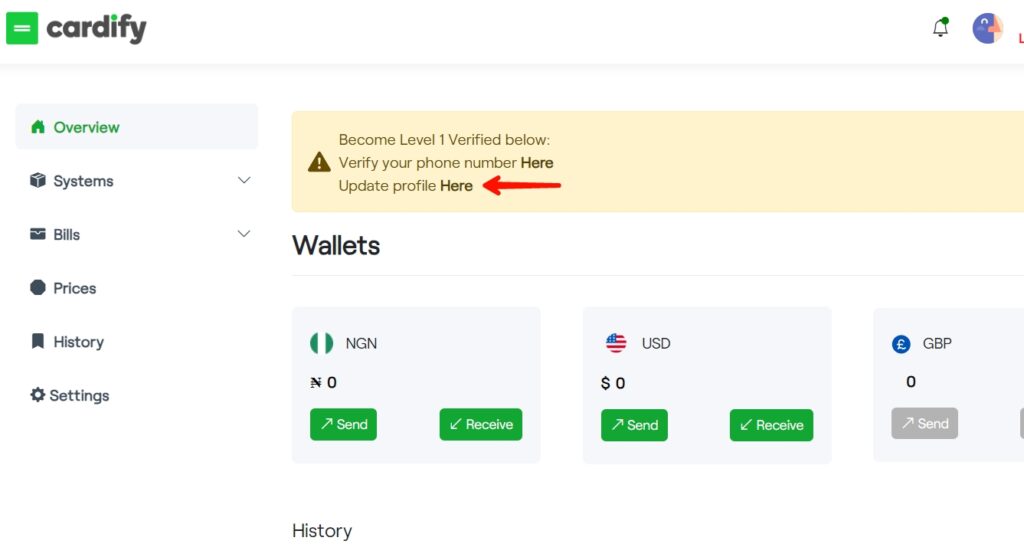

After verifying your phone number, click on the “Update profile Here” section.

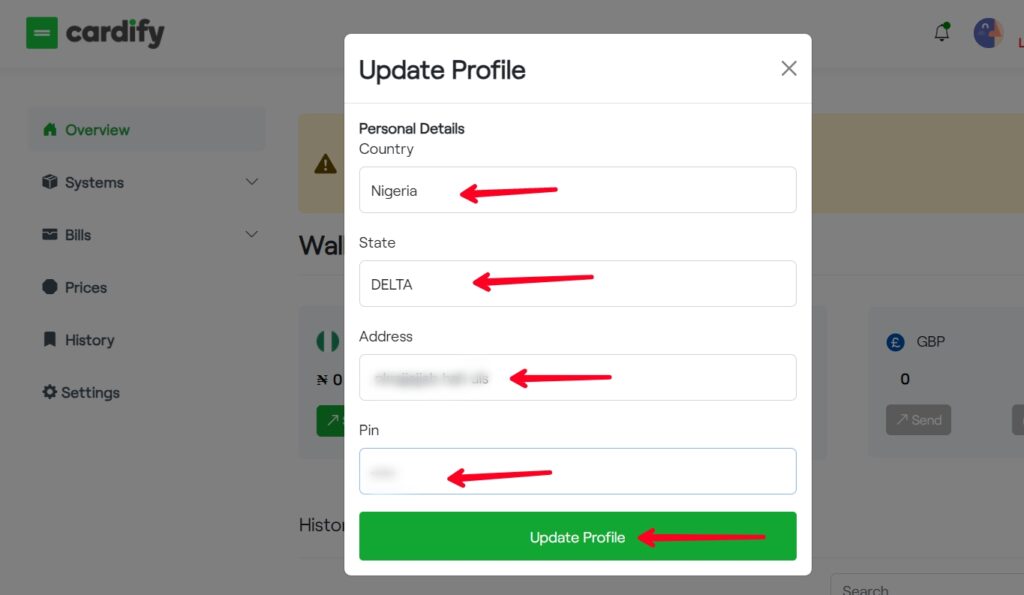

On the Update Profile section, choose your country (which is Nigeria), choose the state you are from, and on the Address field, enter your home address. On the Pin field, Enter at least four digits number that you will use in authorizing transactions on your Cardify account, and then click on the “Update Profile” button.

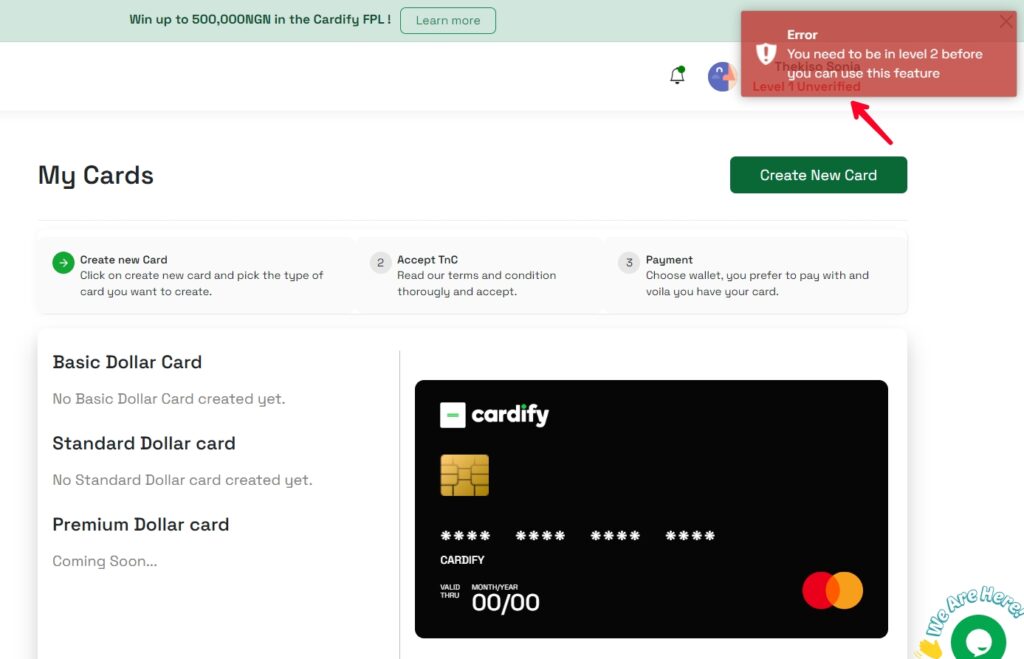

Once you have done that, your account will be verified to level 1. On level 1, you won’t be able to create the virtual dollar card.

To create the Cardify virtual dollar card, you need to upgrade your account to level 2. And to do that, you need to verify your BVN and then activate 2FA. If you don’t know your BVN, dial *565*0# on the SIM card you used in creating your BVN on your bank account.

After entering your BVN, you will receive a code from Cardify on the phone number you used in creating your BVN.

While for two-factor authentication (2FA), Cardify Africa offers two options for 2FA: authenticator app (Google Authenticator) and email one-time password (OTP) methods. You are required to choose one of these methods and complete the setup process.

Once you are done verifying your BVN and setting up 2FA, your account will be upgraded from level 1 to level 2 then you can be able to create the virtual dollar card.

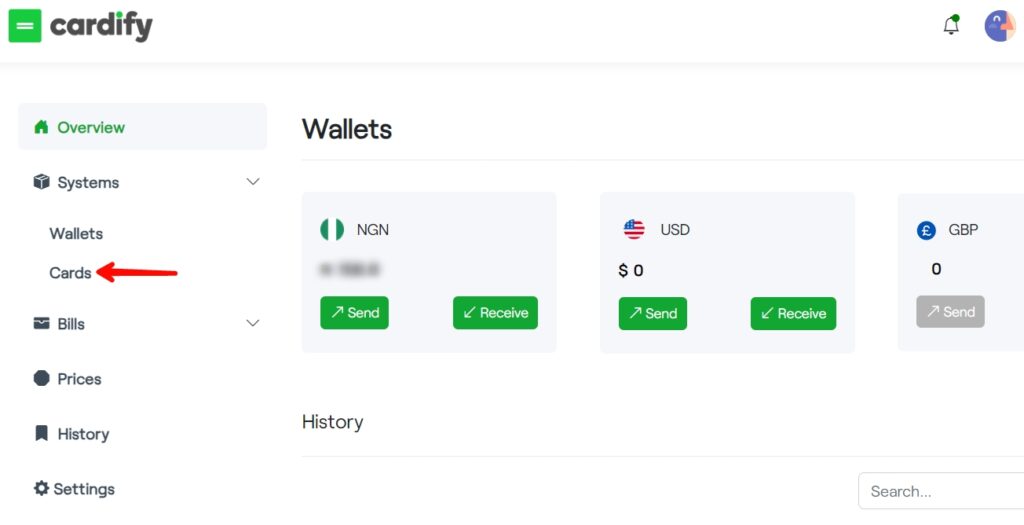

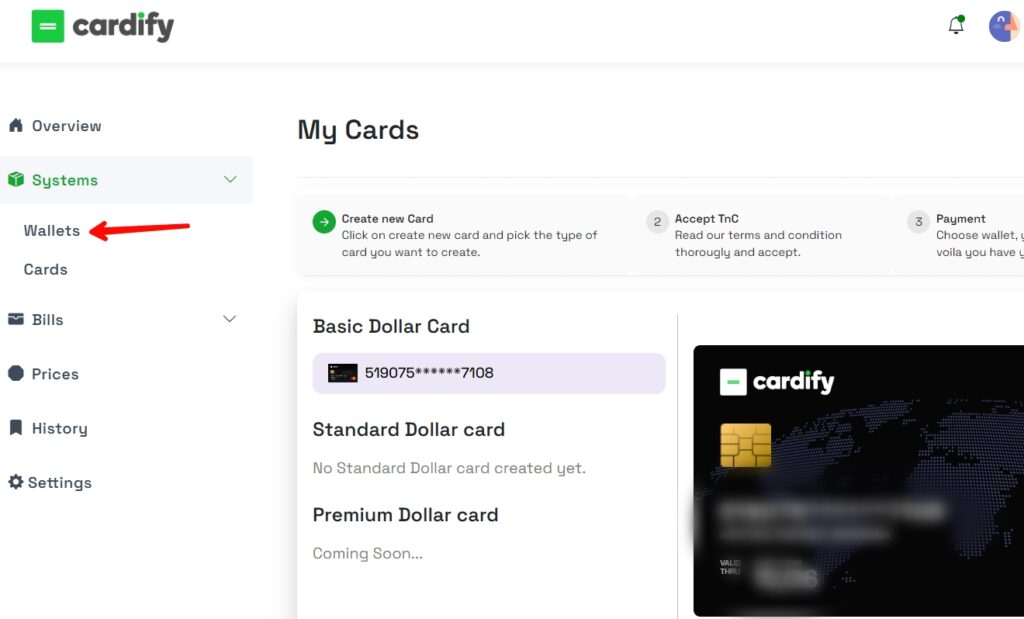

To create the virtual dollar card, click on the “Systems” tab and then click on “Cards“.

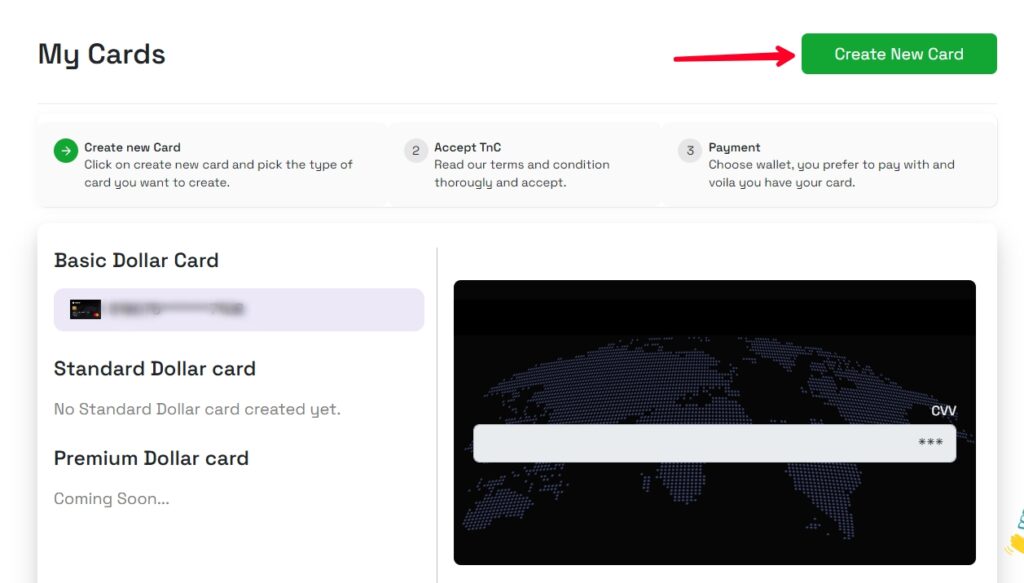

Click on the “Create New Card” button at the top right corner.

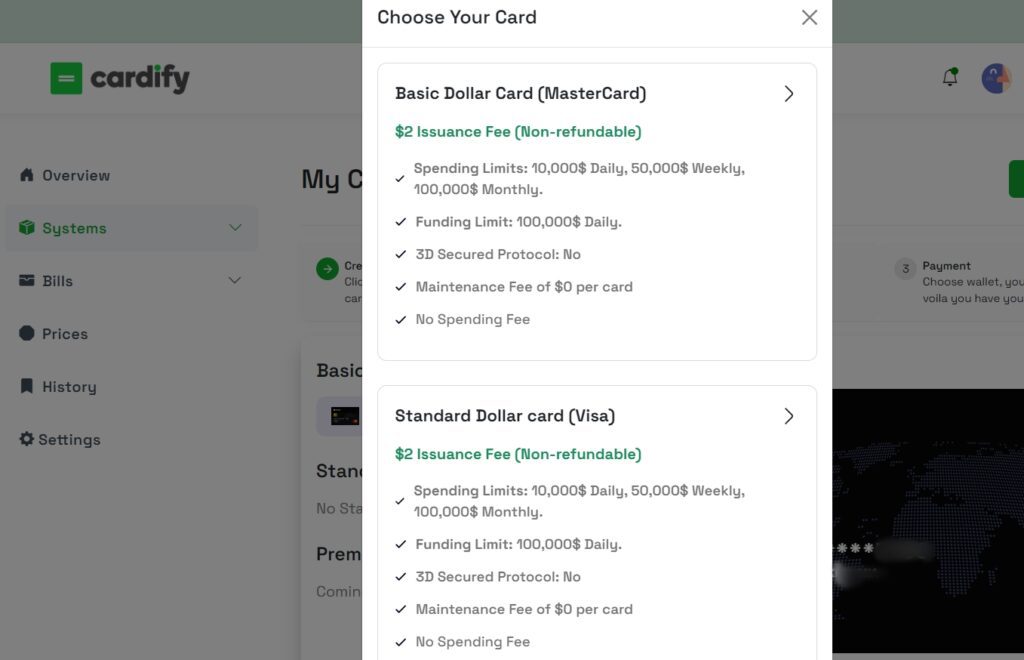

On the Choose Your Card section, you will two types of cards offered by Cardify. The first one is the “Basic Dollar Card” which is MasterCard and the second one is the “Standard Dollar Card” which is a Visa card.

Simply choose one out of the two, I recommend going for the MasterCard. To create the card, Cardify will charge you $2 as an issued fee and $1 + 2% as a funding fee.

Compared to other virtual dollar card issuer platforms that will charge you $5 for a card issuer fee Cardify only charges a $2 one-time fee which is good.

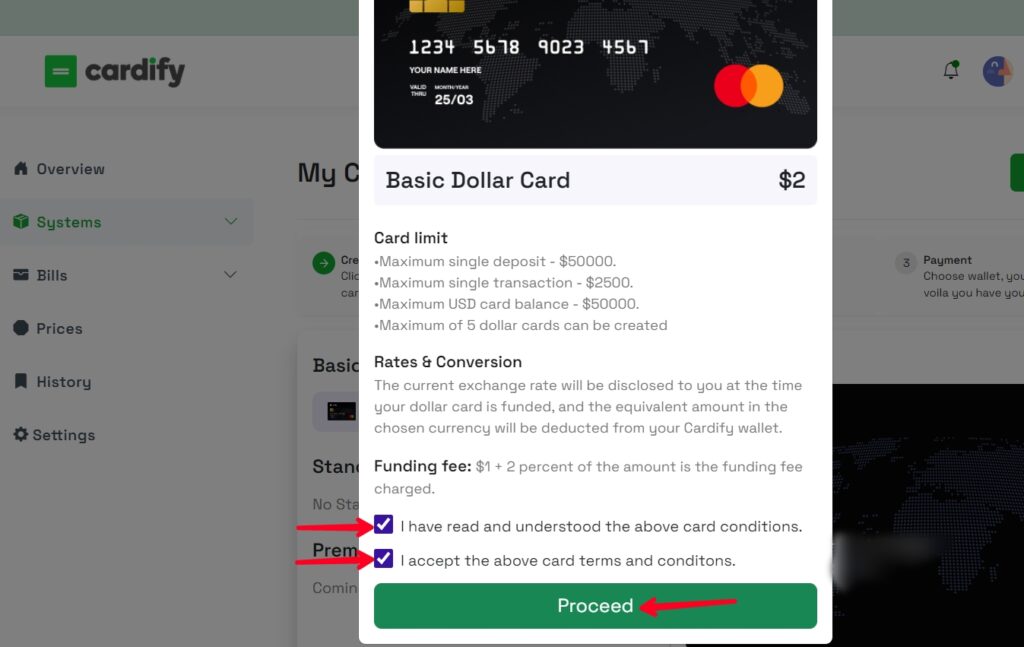

Once you are okay with that, click on the box (I have read and understand the above card conditions) and (I accept the above card terms and conditions) then click on the “Proceed” button to continue.

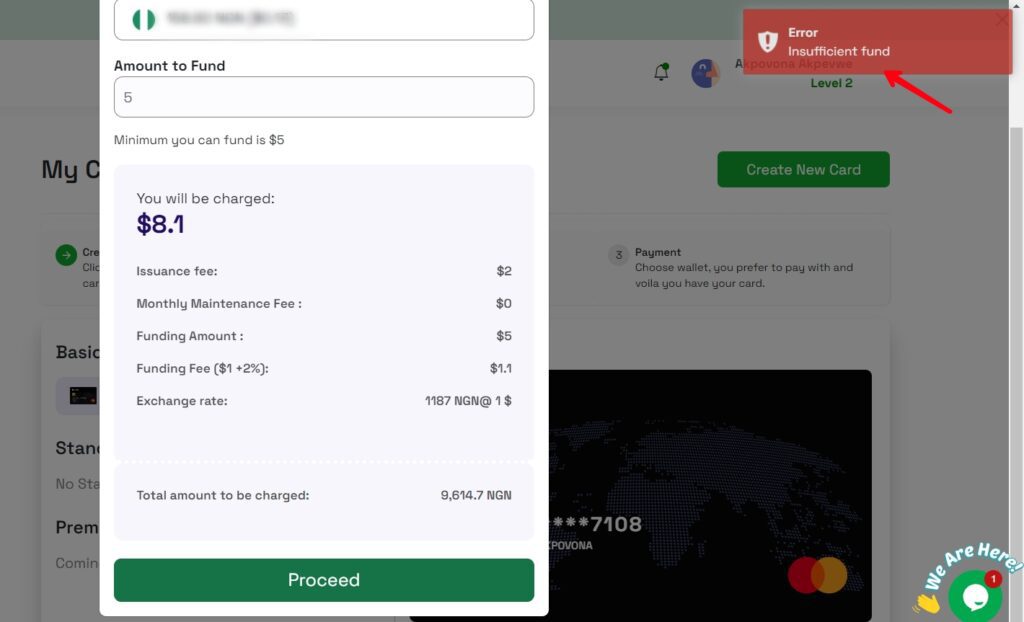

When click on “Proceed” you will then be taken to the page where you can make payment for the card creation. Cardify charges a $5 minimum funding fee + the card issuance fee of $2 + the funding fee of $1 + 2$ (That together is $8.1).

You will be required to pay some of $8.1 which is ₦9,614.7 at the time of writing this article. The exchange rate might increase later or decrease.

Note: The $5 you are funding in addition to the card issuance and funding fee go straight to your Cardify account. This means once you have created the card, the card will have a $5 balance which you can start using to pay for your online transaction.

If you click on the “Proceed” button now, you will get an insufficient funds error message because you don’t have that amount of money in your account.

So you first need to add money to your Cardify wallet account. You can fund it using Naira bank transfer or USDT.

To fund your Cardify account, on the same systems tab you are on click on “Wallets“.

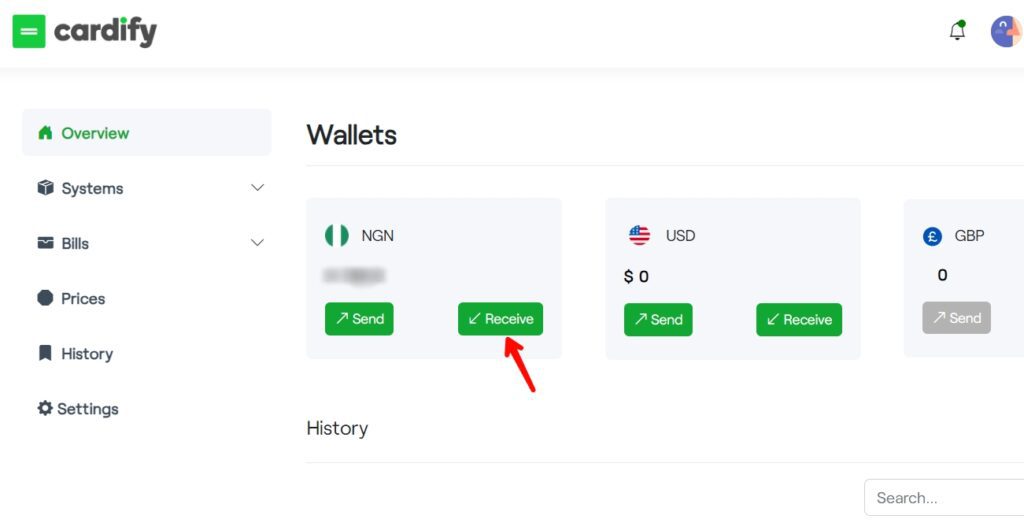

On the Wallets tab, you will three currencies available: NGN, USD, and GBP. To fund your account using Naira, click on the “Receive” button.

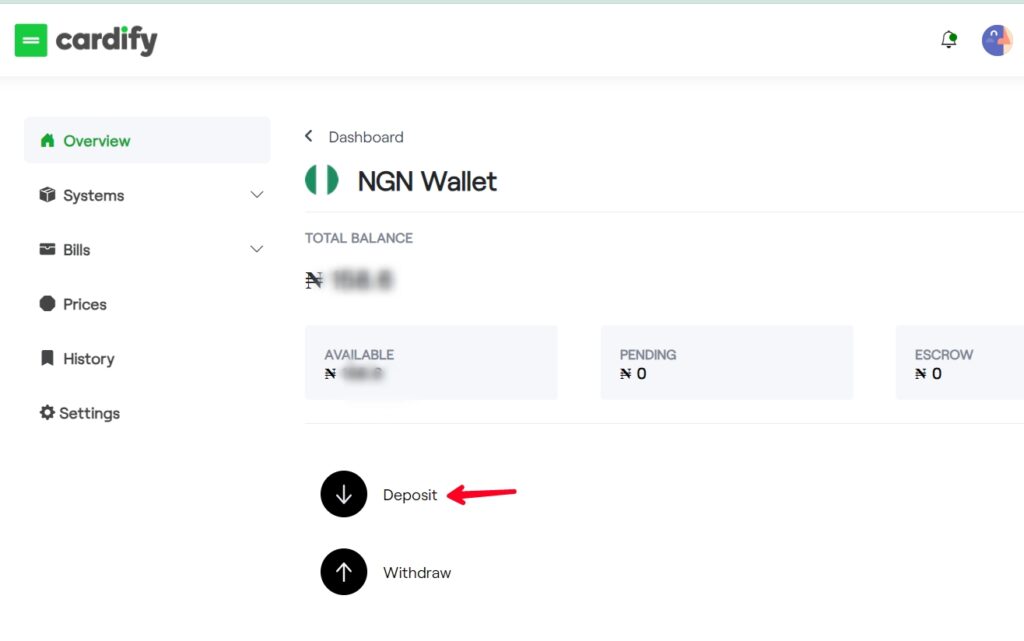

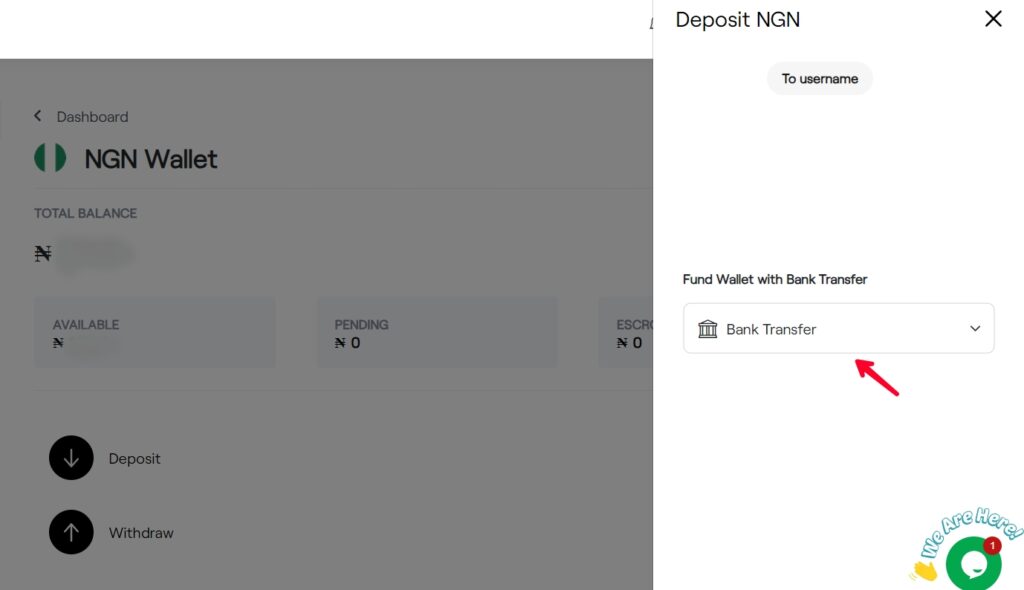

Then click on “Deposit” and then select “Bank Transfer“. You will see an account generated for you, simply transfer any amount you want to fund your account with into the account number.

Once you have an unfunded Cardify account, you can now proceed to create the virtual dollar card following the earlier process mentioned in this guide.

When you have created your card, you can now use it to pay online. We tested the Cardify virtual dollar card on Namecheap when purchasing the domain and it will work. You can try it too and drop your review in the comments section below if it works for you.

Pros of Using The Cardify Virtual Dollar Card

- You can use the card to pay for most of the popular international websites like Netflix, Namecheap, and the rest.

- Cardify doesn’t charge maintenance fees.

- You can fund your Cardify Virtual Dollar Cards cryptocurrency including USDT.

- You can buy airtime and pay bills directly from your Cardify account from your balance.

- According to Cardify, soon they will start offering USD bank accounts to their customers, just like Grey does. This will allow you to get paid in USD.

- Cardify has a mobile app that you can download from the Play Store and view your card details and transactions.

- You can earn cash back for making transactions with your dollar card on Cardify.

- You can earn money by referring people to sign up for Cardify using your invite link.

- You can withdraw back your funds (Naira or USDT) from your Cardify account.

Cons of Using The Cardify Virtual Dollar Card

- The minimum amount you can fund the Cardify dollar card is $5 which can be more than your budget for some moment.

- The funding fee is somehow expensive for $1 + 2%. How wish they could charge only $1 for the funding fee.

- As you can fund your Cardify Virtual Dollar Cards with USDT is good but the value of digital currencies like USDT can fluctuate, which means that the value of your Cardify Virtual Dollar Card could also fluctuate.

- The Naira to USDT exchange rate on Cardify is somehow expensive however, it is worth it.

Conclusion

If you are looking for a cheap dollar card to use in making international payments online, try the Cardify Virtual Dollar Card. We have used the card and it works for us.

Give the Cardify dollar card a try and drop your review about it in the comments section below to help others choose the best card to use. Please don’t forget to share this guide with those who may need it.

Special Web Hosting Offer | $2.99/mo